Aiming to take a loan? Want to be assured of a loan approved and processed quickly? Are you looking for a loan at a lower interest rate? The only answer to these questions is to maintain a good CIBIL score. At this point, you may have more questions like what is CIBIL score?

Explaining what CIBIL score is?

The CIBIL Score is a 3–digit numeric summary that works as a first impression for the lender, which means the higher the score, the better the likelihood of your loan being approved. This 3-digit number ranges between 300 to 900. The closer a score is to 900, the greater the probability of a loan getting approved.

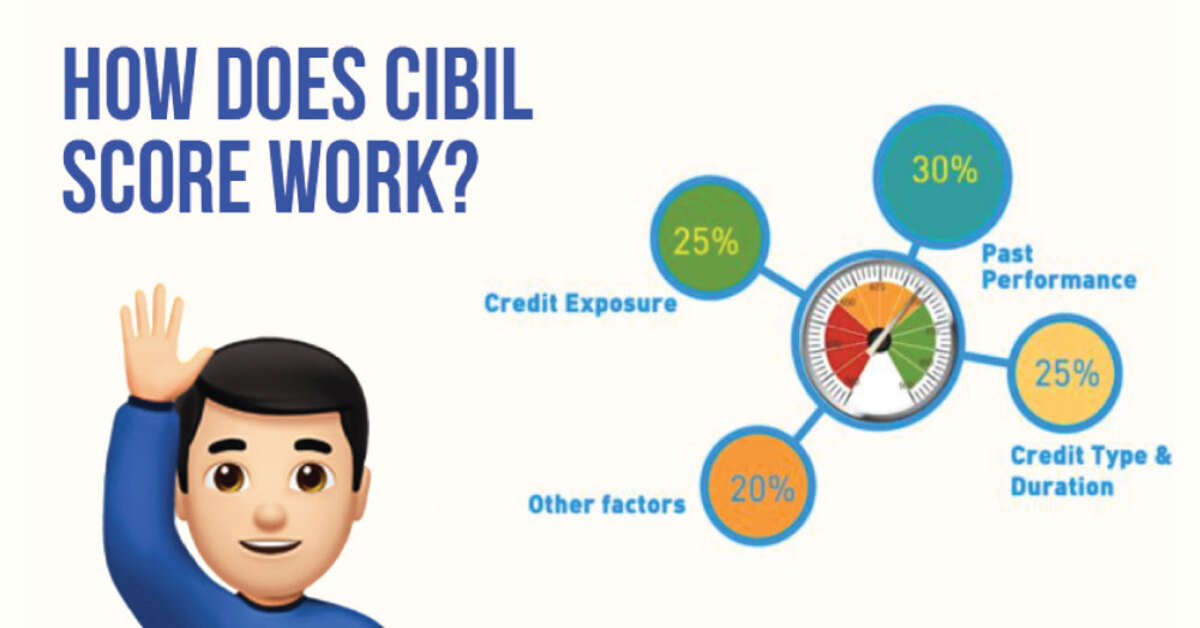

Individuals’ past behavior is taken as an indicator of their future actions, such that CIBIL is a picture of a person’s creditworthiness. This is generally based on past credit transactions, such as borrowing and repayment practices of your dues. It is a report of a customer’s credit history and a representation of the person’s credit profile.

Also, read: How to get an Instant Small Cash Loan on Aadhaar Card?

Who estimates the CIBIL score?

Credit Information Company (CIC), or Credit Bureau is India’s leading credit information company. The credit bureau was established in 2000. It uses information provided by the bank about past credit history. The main purpose of a CIBIL score is to predict the risk of you not repaying a future loan.

The seriousness of a good CIBIL Score

A credit score is one of the key points that affect your eligibility for credit. It is a measure that tells a lender whether the loan can be given or not, the person will not repay on time.

A few clicks to fix your CIBIL mix

Here are some of the reasons why CIBIL scores should always be kept high:

1. For quicker loan approval

There are generally some misunderstandings that the lender will easily give a loan by providing some security. But that is not completely true, your credit report will still be evaluated by the lender. This is how the lender decides the upper limit and the interest rate on the loan. With a poor CIBIL score, the whole process can get complex.

2. Lower interest rates

The Interest rates of different loans differ from bank to bank. Some people enjoy a better deal than others. A higher CIBIL score allows you to negotiate with banks for a better interest rate.

3. Comparatively less premium for insurance

Insurance is another financial tool that performs mainly on credibility, be it life insurance, medical insurance, or others. Your past repayments, claiming history, and general handling of dues – all these are monitored carefully by the insurance companies. This helps them to determine if you will get a lower premium compared to other policyholders.

4. Option to choose best credit card

Credit cards, if used wisely, can give maximum benefits. Though they have a definite zero-interest period, the interest rates can rise sharply when you delay payment. With a good score, credit card companies will give you the best possible deal. Or else, you can end up with a credit card with a high-interest rate.

Tips to Improve CIBIL Score

- Avoid acquiring too much credit in a short span of time.

- Ensure repayment of all EMIs and credit card bills on the due date.

- If you don’t have any credit experience, try to get a personal loan and repay it timely to build a good credit score.

- Choose a shorter loan period to repay the loan faster.

The bottom line

A better credit score is a worthy goal, especially if someone is planning to apply for a personal loan, such as a home loan, or some car loan. Always try to maintain a good credit profile regularly to ensure you are ready for a loan when you need it. The sooner you start working on improving your credit score, the sooner you will see results.

This post is also available in: हिन्दी (Hindi)