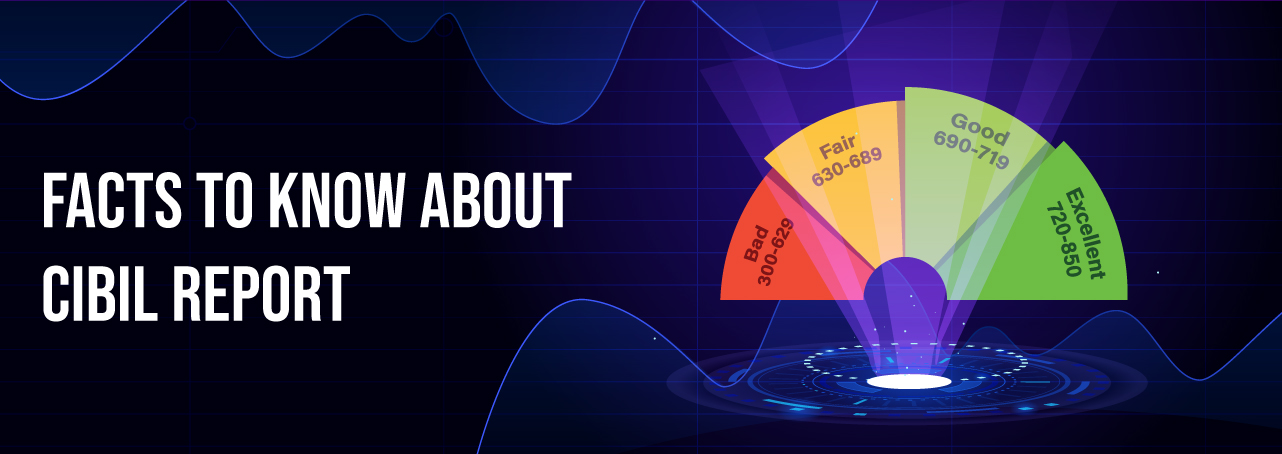

A proper understanding of your CIBIl is necessary when you are trying to avail a loan. A CIBIL score is more than just a 3-digit credit number as it is generated based on the past credit information of an individual. It ranges from 300 to 900. A score above 700 is considered for the application for a successful loan or credit card. A CIBIL report comprises a comprehensive report on the debts you have taken, like personal loans, education loans, home loans, car loans, credit cards, and many more. CIBIL report will reflect your payment history of the debt borrowed over a while.

Apart from helping in credit approval, there are numerous fun facts about the CIBIL report you must know.

You cannot get a loan with low CIBIL

Availing of a loan is impossible with a low CIBIL score is not applicable in all cases. Various banks have particular credit score cut-offs for different types of loans. A low score may lead you to some rejections from creditors, that does not mean that you won’t get a loan ever. There are possibilities to get a loan but at a high-interest rate.

Also, check: How to improve CIBIL score?

If you have never asked for your CIBIL score, it does not exist

Many people have misinterpretation it as they have never requested their CIBIL Report, so it doesn’t exist. However, that is not true. Each month, lenders such as banks or any other financial institutions report the credit information of all borrowers to credit bureaus. Accordingly, if you have a credit history, your credit score still exists.

A few clicks to fix your CIBIL mix

CIBIL can edit any information from your credit record

CIBIL generates the credit report based on the credit information that they have received from various lending organizations such as banks and NBFCs. They do not have the power to edit any credit information. Changes are only authorized and provided by credible sources.

A defaulter’s list is maintained by CIBIL.

It is a common misconception that CIBIL maintains a defaulter’s list. But, in actuality, CIBIL or any other credit bureaus do not keep a defaulter’s list. CIBIL and other credit bureaus are only managing and keeping individual credit records provided by lending institutions such as banks and NBFCs. The choice of granting a loan depends on lenders.

CIBIL score might differ from credit scores generated by other credit bureaus.

Credit scores generated by several credit bureaus might differ. This is because individual credit bureau has their scoring model to determine credit scores. Another cause why your score varies from the credit scores generated by other credit bureaus is because the updated credit information was not reported to bureaus on the same day.

Closing your old credit accounts will boost your credit Report.

Many people have this misconception that closing their old loan accounts will help them to boost their CIBIL score. But, the fact is that closing your old credit accounts impacts negatively on your score.

Lenders generally prefer lending money to people who have stable credit histories.

Conclusions

As per the present standards, a CIBIL score above 700 is recognized as a good score. Anything less than that leads to rejection of the loan. This may seem a bit unfair, but it makes sense from the bank and other financial institutions’ points of view. With a better CIBIL score you can get quick approval and a better interest rate.